#abe garver

Explore tagged Tumblr posts

Text

Private Equity 101 for MSPs: New Platforms vs. Add-Ons

Over the past 18 months Abe Garver (FOCUS’ MSP Team Leader) has catapulted eight (8) MSPs into “New Platforms” for private equity groups (PEGs). Six (6) of the 8 run on ConnectWise’s RMM/PSA and two (2) of the 8 run on Datto’s Autotask RMM/PSA software

New Platform investments are the life blood of private equity, as they are viewed as the starting point for more acquisitions in the future. Conversely a strategic “Add-On” is designed to complement an existing platform business.

For New Platforms, PEGs have historically viewed each transaction as stand-alone. There are no synergies to consider, there is only a transaction with an investment rationale on how to grow the business and generate a targeted return. That rationale is the driver behind the deal, and it defines how the PEG will create value through things like capital infusions, operating partners and even future add-on acquisitions.

However, because of the limited supply of New Platform MSP assets (e.g. in the $2.5MM-$5.0MM EBITDA range), PEGs that want a New Platform are turning to M&A advisors like FOCUS’ MSP Team to find Merger of Equal targets to combine.

Combinations like Domain Computer Services and Tier One are especially appealing to PEGs when there is a:

1. Cultural 'fit'

2. Geographic 'fit'

3. Strategic 'fit' (e.g. cross-selling opportunities)

4. Financial 'fit' (e.g. pro-forma EBITDA of $2.5MM to $5.0MM)

5. Low integration risk (e.g. similar 'tech' stacks)

6. Leadership gap being filled

7. Inactive shareholder being taken out, and

8. Reduction of customer concentration

Interestingly Mr. Garver states that 4 of the 7 MSPs he advised in 2020 would not have been offered a New Platform investment had it not been for their use of M&A with IT Nation peers.

In Mr. Garver's opinion the trend is gaining momentum as 88% (7 of 8) MSPs he is advising on New Platform transactions in 2021 are also employing M&A with peers to increase their MSP’s marketability and valuation.

For Add-On acquisitions, PEGs frequently lean more on the expertise of its relevant portfolio company's management to determine the fit, synergies and strategic benefits of a transaction.

However Mr. Garver cautions that, ”On the buy side private equity groups show up for important first calls with their portfolio companies. This is especially important when offers involve rolling equity.”

For New Platforms without a strong track record of M&A, it is a disaster when PEGs won’t provide adequate support which I also experienced last year advising a New Platform on the buy side.

I advised Network Support Co. in its sale to Logically which is PE-backed by Riverside. Riverside did an incredibly efficient job of supporting Logically assess fit, synergies and strategic benefits of the transaction.

When talking to a PEG, try to understand what their investment case is. Why are they interested in your MSP? Are they planning to consolidate it with a Platform? What is their plan for helping the MSP grow?

For New Platforms, key questions PEGs focus on include:

1. How attractive is our industry from a total addressable market and compound average growth perspective (link)?

2. Does the target MSP have multiple avenues of growth?

3. How can we, as a financial sponsor, add value?

4. What is the path to generating an acceptable risk-adjusted return?

Mike McInerney, Director at Prospect Partners adds:

5. How many new customers / how much new business has the company added over time? In other words, what’s the pace of growth?

6. How does customer retention look?

7. Normalized cost structure – additions/subtractions to the existing P&L?

8. For add-ons, how do we integrate the businesses?

On the other hand, PEGs buying a MSP as an Add-On are much more focused on the strategic and financial benefits of adding an acquisition to an existing portfolio company. The strategic side is more clearly defined because the add-on is serving a more specific purpose (e.g. geographic expansion, new products, complementary customer base, economies of scale, etc.). Thus, the Add-On can be narrower in focus and growth potential.

For Add-On acquisitions, PEGs ask questions such as:

1. How does this acquisition support the platform company?

2. Does this make the two businesses more valuable together than separate and what are the tangible synergies?

3. How will this increase the overall return to investors and is this an acceptable return on capital?

MSP owners need to be aware of these differences in perspectives because they have a significant impact on how PEGs will view your business and what they are willing to pay. If you're an Add-on, you probably offer the PEG some synergies. If you are a New Platform, you probably need to prove your growth story more.

Where can you start?

1. Join a Peer Group (IT Nation Evolve Peer Groups by ConnectWise)

2. Email FOCUS’ MSP Team Leader, Abe Garver, or one of his references about their experience.

Abe Garver

Managing Director & MSP Team Leader

8065 Leesburg Pike, Suite 750

Vienna, VA 22182

Cell 646.620.6317 | Connect on LinkedIn

[email protected] | www.focusbankers.com/msp

Washington DC Metro | Atlanta | Los Angeles Metro |

#MSP#private equity#platform acquisition#add-on acquistion#abe garver#FOCUS Investment Banking MSP Team

0 notes

Photo

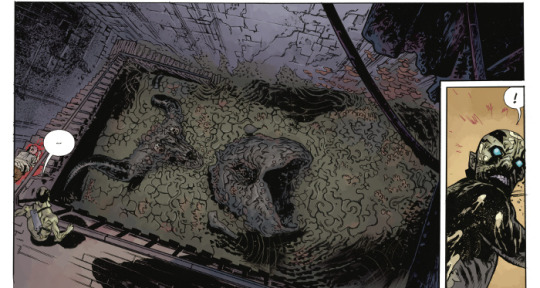

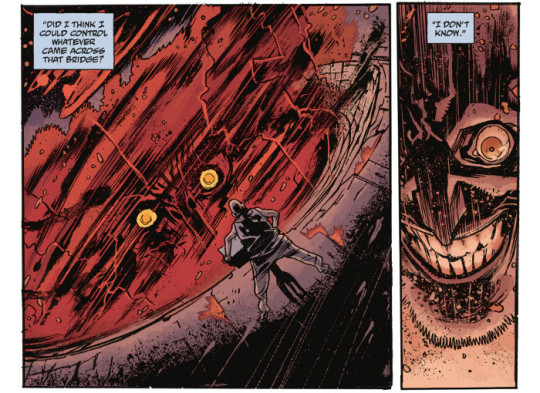

Abe Sapien: The Devil Does Not Jest & Other Stories - “The Devil Does Not Jest”

Words: Mike Mignola & John Arcudi | Art: Peter Snejbjerg | Colours: Dave Stewart | Letters: Clem Robins

Originally published by Dark Horse in Abe Sapien: The Devil Does Not Jest #1-2 | September-October 2011

Collected in Abe Sapien - Volume 2: The Devil Does Not Jest and Other Stories | Abe Sapien: The Drowning & Other Stories

Plot Summary:

In 1985, Abe travels to Maine to talk to the son of a demonologist who disappeared fifty years earlier, and gets a bit more than he bargained for.

Reading Notes:

(Note: Pagination is solely in reference to the chapter itself and is not indicative of anything within the issue or collections.)

pg. 1 - I think this is an interesting way to start out the story. A splash of Abe being feasted upon by something we know nothing about. It certainly doesn’t look good for him and those toothy maggot things sure are creepy.

pg. 2 - Made more interesting because we’re given no context for it. We’re left unsure if it’s a flash forward, a flashback, a random daydream...it’s just there and then we’re into business as usual at BPRD HQ in Connecticut.

pg. 3 - I like set up of a missing author of demonology and how mundane his rediscovery happens to be. It makes everything feel normal and unassuming as we dive in to find out more.

pg. 5 - This just feels like the set up for something to go horribly, horribly wrong.

pg. 8 - That didn’t take long. The gore from Harren and Stewart is impressive.

pg. 9 - I love the inexplicable over the top violence here. There’s seemingly no reason for it, and seeing Abe and the Sheriff perplexed by it is hilarious, but normal.

pg. 10 - Why is there pretty much never any interoffice cooperation between levels of law enforcement in fiction? I mean, it may or may not be true in real life with separate jurisdictions, but it always just feels like a sad pissing contest. Less people would probably wind up dead if branches just trusted one another.

pg. 14 - These demon dog things are damn neat.

pg. 15-18 - Just great action of Abe versus these creature things.

pg. 20/21 - Amazing double-page spread. That’s certainly something different to find in someone’s basement. Who keeps a demon corpse? (Obviously you break it down, use parts for other rituals, and sell off some of the pieces to occult collectors for a. money and b. the joy of being the originating point of an eventual series of cursed artifact situations with face-replacing cults and taxi chases).

pg. 22 - Ouch. Also, another great design.

pg. 23 - I like that Harren seems to be using the same overall design and clothing for Liz as what we saw from Jason Pearson building off of Mignola’s original in Seed of Destruction.

pg. 25 - This is funny as hell. Also, I didn’t mention it before, but it’s good to see Sal Tasso again, even if he is still a bit of a lunkhead. Adds a nice bit of consistency and variety.

pg. 26 - We seem to have finally come around to the opening page of the story. Interesting, that. I wonder if Abe’s just been bleeding out, recollecting what brought him to this point all this time. Definitely an interesting structural choice for the narrative.

Also, transposing the “About the Author” photo and blurb atop the ghost/hallucination version of Garver Van Laer is neat. Nice way to convey who he is without spelling it out.

pg. 27 - This is funny. Also, I love how trippy the art is becoming down in the basement.

pg. 29 - The madness comes across incredibly well on Van Laer’s face. Also, let it be a lesson to everyone. If you don’t know what you’re doing with the occult, don’t start dabbling at the deep end. Work with banishing rituals and cleansing rituals first. Baby steps to build up your acumen and experience. Don’t just read it in a book and assume you can do it.

pg. 32 - It’s kind of neat that it’s a traditional demon form, though. Out of all of the strange stuff we have running around in this story, this is the most normal out of all of it.

pg. 33 - This is great. A wonderful twist in the tale to change it from a simple demon tale spinning out of a long lost missing persons case to a family-based body horror yarn. That third panel above is just chilling.

pg. 34 - I think maybe we just got an answer for why Garver’s son went nuts and slaughtered his nephew in the first bit. Also, it’s amazing as to how mundane Garver’s end was.

pg. 35 - It’s an odd bit that the Sheriff is still alive.

pg. 36 - I’m surprised Abe doesn’t remember her from before, but I guess he didn’t see who knocked him out. We now know, though, that this is Garver’s wife, still alive, and even more hideously transformed. I love how creepy Harren and Stewart make this look.

pg. 37-39 - More amazing action. It’s the kind that makes you slow down and just savour what’s going on.

pg. 40 - To the bitter end. Great composition here.

pg. 41 - The set up making us think that anything horrible happened to Abe is cute.

pg. 42-43 - Another amazing double-page spread. Killing Garver’s wife sure is tough work.

pg. 44 - And the humour of Hellboy and Tasso walking in on the tail end of that, right after Abe is finished is gold.

Final Thoughts:

I’m always amazed by the sheer depth and breadth of the talent pool that has worked on the Hellboy universe. Though this was still early in James Harren’s comics career, and his first for the Hellboy universe, this art is fantastic. Great storytelling, some of the best creature designs, the range of emotion on characters’ faces, the kinetic action sequences, and a highly unique style. Sure, there’s hints of Adam Pollina, Troy Nixey, Guy Davis, Eric Powell, The Pander Bros., Ted McKeever, John McCrea, even some Mignola himself, and more in there, but James Harren has always seemed to transcend his influences to create something visually stunning.

d. emerson eddy is not a brick. Nor is he drowning slowly.

#Give 'em Hellboy#Hellboy#Abe Sapien#The Devil Does Not Jest and Other Stories#Mike Mignola#James Harren#RaisingHellboy#173

18 notes

·

View notes

Text

FBB 2019: My $1 Wonders

As it turns out, most of the players I spent money on underperformed, but many of my $1 players have outperformed what I paid for them: My $1 Wonders Renato Nunez - not hitting for BA, but has 20 HRs Luery Garcia - (a pick-up) has hit for average and has 8 SBs Freddy Galvis - decent BA, 15 HRS & 44 RBI Robert Perez - (another pick-up) 11 HRs in only 118 ABs for my team Tim Beckham - fell into a slump but still has 14 HRs & 48 RBI Hansel Robles - 11 Svs Honorable Mention: Mitch Garver ($5 Frz) - 13 HRs, 34 RBI, .302 BA

0 notes

Text

Kohl’s hires away Walgreens’ e-commerce chief

Guest Post: BY SANDRA GUY Senior Editor Internet Retailer

Kohl’s aims to boost customer engagement with mobile devices and apps as Walgreen’s did under Sona Chawla’s leadership.

Kohl’s Corp. has hired Walgreens Boots Alliance Inc.’s e-commerce chief, Sona Chawla, to its newly created position of chief operating officer, as the department store aims to increase its customer engagement via apps, e-commerce and mobile devices.

Kohl’s, No. 22 in the Internet Retailer 2015 Top 500 Guide, announced Chawla’s hire Tuesday. Chawla, who will start Nov. 30, will oversee e-commerce strategy, information and digital technology, planning and operations, and logistics and supply chain network, in addition to store operations and store construction and design, Kohl’s said.

Kohl’s, which does not break out quarterly e-commerce sales, last week reported third-quarter earnings, and for the first nine months of the year, net revenue was $12.82 billion, up 1.2% from $12.67 billion during the same time last year. E-commerce sales for 2014 were $2.17 billion, up 23.3% from $1.76 billion in 2013, according to Top500Guide.com data. The company in September relaunched its mobile commerce site with an eye toward making it easier for on-the-go shoppers to buy online.

“Kohl’s want its apps, e-commerce and mobile strategy to help differentiate itself competitively and be seen as a thought leader in the digital space,” says Forrester Research analyst Brendan Witcher.

“Kohl’s is asking themselves, ‘How can we offer something new?’” he says. “When Neiman Marcus introduces Snap. Find. Shop feature, Kohl’s leaders are asking, ‘Why didn’t we do that? We need to bring in the kind of talent that can create that level of creativity.’”

CEO and president Kevin Mansell said of Chawla’s hire, “We saw an enormous opportunity to create something truly unique in retail—a leader who has oversight for the full omnichannel experience. When stores, online and digital teams are not just compatible but truly integrated, new thinking and new ways of delivering a seamless customer experience emerge.”

Chawla’s hiring also coincides with Kohl's push to target female customers as parents shopping for their families and as women looking for fashion and workplace apparel.

But challenges are ahead for Chawla and Kohl’s, Abe Garver, M&A adviser with BG Strategic, says. “Walgreen’s, where Sona comes from most recently, is a $90.3 billion dollar company, while Kohl’s is 10x smaller ($8.6 billion). I understand Kohl’s may be fast-tracking Sona to take over the CEO position, and I would bet on her to turn the e-commerce business around. My concern is that the deck is very stacked against her given her new employer has $5.1 billion of debt on the balance sheet,” Garver says.

As Walgreen’s president of digital and chief marketing officer, Chawla led a team responsible for increasing such customer conveniences as refilling prescriptions in seconds, printing photos from smartphones directly to stores, linking its loyalty program with Apple Pay, and launching digital health coaching and health apps. Walgreen is No. 44 in the 2015 Top 500 with an Internet Retailer-estimated $1.13 billion in web sales in 2014, up 15.4% from $975.0 million in 2013, Top 500 data shows.

Prior to joining Walgreens, Chawla was vice president of global online business at Dell Inc.; executive vice president of online sales, service and marketing at Wells Fargo’s Internet Services Group and worked at Andersen Consulting and Mitchell Madison Group.

Follow @SandraGuy and @AbeGarver on Twitter. For a portfolio of Sandra’s stories click Internet Retailer and MuckRack

#Abe Garver#BG Strategic Advisors#Internet Retailer#Internet Retailer 2015 Top 500 Guide#Sandra Guy#kohl's#Sona Chawla#walgreens#$KSS#$WBA#neiman marcus#Apple pay#$AAPL#Dell#Wells fargo#$WFC

1 note

·

View note

Text

Why Shopify Stock May Drop 40% After Q3 Beat

In Shopify’s Q3 2015 earnings report, the Company told us that 56.1% ($29.6M/$52.8M) of its revenue comes from ‘Subscription Solutions’ (a.k.a. Software-as-a-Service or SaaS) and the balance 43.9% ($29.6M/$52.8M) from ‘Merchant Solutions’. Why is this important?

Having recently represented a seller of an Inc. 500 Fastest Growing in the sale of its SaaS business, I know from negotiating valuation with sophisticated strategic and financial buyers (e.g. private equity groups) that investors won’t pay a premium SaaS valuation for any revenue that: (1) Isn’t SaaS or (2) Has a low customer retention rate. In the case of Shopify 43.9% of the Company’s revenue isn’t SaaS, and its customer retention rate (reported at over 100.0%) was calculated in a non-traditional manner that in my opinion significantly overstates retention.

Why I think Shopify stock could drop 40%

In Buy or Sell Shopify? What You Need To Know About Amazon’s Favorite Ecommerce Firm I stated that over a sample of 38 public Software-as-a-Service (SaaS) companies, enterprise value / revenue valuation multiples ranged between 2.0x and 28.9x, with a median of 6.8x and mean of 8.0x. If we counted all of Shopify’s revenue as SaaS (what I believe the market is doing right now) the Company shares currently trade at 15.1xrevenue. However only $81.23M ($144.8M * 56.1%) is SaaS.

Dividing Shopify’s $2.18B enterprise valuation by $81.23M of SaaS revenue implies a 26.8x enterprise value / revenue valuation multiple. That’s ridiculously high to me in light of the fact that merchant retention is ’consistent with what we would associate with early stage businesses’ (page 55 of Form F-1). Of course there is value in the low margin Merchant Solutions (Merchant Payment) business, but overall Shopify loses money and the merchant payment business is wildly competitive so I’m not inclined to assign a nose bleed valuation to that segment of the business.

101.0% customer retention rate ‘may be calculated in a manner different than (that) used by other companies’

(Financial table presented in F-1 Filing)

(As described in Form 6-K)

Key performance indicators that we use to evaluate our business, measure our performance, identify trends affecting our business, formulate financial projections and make strategic decisions include Monthly Recurring Revenue and Gross Merchandise Volume. Our key performance indicators may be calculated in a manner different than similar key performance indicators used by other companies. We calculate Monthly Recurring Revenue, or MRR, at the end of each period by multiplying the number of merchants who have subscription plans with us at the period end date by the average monthly subscription plan fee revenue in effect on the last day of that period, assuming they maintain their subscription plans the following month. MRR allows us to average our various pricing plans and billing periods into a single, consistent number that we can track over time. We also analyze the factors that make up MRR, specifically the number of paying merchants using our platform and changes in our average revenue earned from subscription plan fees per paying merchant. In addition, we use MRR to forecast and predict monthly, quarterly and annual subscription solutions revenue. We had $ 9.8 million of MRR as at September 30, 2015 .

The Big Picture

Although I’m critical of the company’s valuation, you may be surprised to hear that I am one of the 200,000+ merchants using its product (See ShoppablePics.com). In my experience a key point of differentiation that I’ve found is that merchants are able to sell products through Facebook, Twitter and Pinterest. Given the market for social commerce is so massive (FB has 1.5 billion monthly active, Instagram and Twitter are in the 300 million monthly active range) it’s likely that Shopify will continue to grow at a healthy clip, and ultimately become profitable. Until that happens though I would be a seller and not buyer of the stock.

Follow me on Twitter @AbeGarver

I am not receiving compensation for this article. I wrote it myself and it expresses my opinions, and not those of my employer, BGSA. To avoid a conflict of interest, I don't trade stocks.

#shop#Shopify#ShoppablePics#ShoppablePics.com#abe garver#Shopify Q3 2015 earnings report#SaaS Valuation#Inc 500 Fastest Growing

1 note

·

View note

Text

Buy Or Sell Share of Shopify? What You Need To Know About Amazon's Favorite Ecommerce Firm

Summary

Shopify's stock is up 113% since it's May 21, 2015 IPO, due in part to recenlty announced partnerships with Facebook, Amazon and Twitter.

Shopify is growing revenues quickly (average 89.7% quarterly year-over-year growth), however its SaaS (Software as a Service) revenue is growing slower than its Merchant Payment (MP) revenue.

Mix of revenue is approximately 60% SaaS and 40% MP. According to its financial disclosures, MP revenue is much lower margin, than SaaS.

Shopify stated in its offering documents that merchant retention is 'consistent with what we would associate with early stage businesses'

From a valuation perspective, there are a number of red flags for us to keep out eyes on.

Shopify offers a cloud-based all-in-one commerce platform that's used by more than 175,000 small business merchants. On it's first day of trading in May, shares skyrocketed 51% (from $17 to $25.68). In less than five months the stock is up another 41% (to $36.21). The company's market capitalization (# of shares outstanding multiplied by stock price) is $3.0 billion dollars. In the latest twelve months Shopify lost $16.9 million dollars, on $144.8 million of revenue. What is driving the meteoric rise in the stock, and should you be a buyer or seller of Shopify stock (NYSE: SHOP)?

Recent Partnership Announcements with Facebook, Amazon Twitter and Pinterest

The market for social commerce is a massive. And new sites like ShoppablePics.com are springing up help facilitate it. Facebook (NASDAQ:FB) has 1.5 billion monthly active, Instagram and Twitter (NYSE:TWTR) are in the 300 million monthly active range). On September 16, Facebook said Shopify merchants will soon be able to sell their wares through a new Shop section on small business Facebook pages. When a user clicks on a product, merchants can either direct shoppers from Facebook to their online store or let them checkout directly on the Facebook site or mobile app. Shopify will handle payment processing and transaction tracking. On September 17, Amazon (NASDAQ:AMZN) selected Shopify to be its preferred platform for helping small and midsize retailers build and manage online stores. Then on October 6, Shopify launched a partnership with Twitter to allow Shopify merchants to sell products directly on Twitter. Twitter's "Buy Now" buttons will be available to U.S.-based Shopify merchants. The Canadian company has also inked a partnership with Pinterest that allow its merchants to sell products via buyable Pins.

Financial considerations

Shopify is growing revenues quickly (average 89.7% quarterly year-over-year growth), however its SaaS (Software as a Service) revenue is growing slower than its Merchant Payment (MP) revenue

Mix of revenue is approximately 60% SaaS and 40% MP

According to its financial disclosures, MP revenue is much lower margin, than SaaS

To be successful, SaaS companies count on very high user retention (e.g. 90% of new merchants are still customers at the end of the year)

Shopify stated in its offering documents that merchant retention is 'consistent with what we would associate with early stage businesses'

8 out of 10 SMBs fail in the first 18 months (Forbes)

Shopify merchant perspective

About a month ago I decided to experiment with the Shopify platform to see how much time and effort it would really take to launch a business on the platform. Here is what I found:

In general the platform is robust there is a growing community of 3rd-party app developers (who have created about 1,000 apps)

There is a steep learning curve to get up and running (I'm still not 100% ready to launch ShoppablePics.com)

When I needed phone support to customize my site, the experience was akin to Apple's (NASDAQ:AAPL) genius bar (no availability today)

The 20 minute support call I scheduled, didn't resolve all my issues, so it was recommended that I hire a 3rd-party "expert"

"Liquid", the backbone of Shopify themes (and also used to load dynamic content on storefronts) is not a common programming language

I tend to complete things that I start, so expect the store to be live soon

The jury is out on whether I'll still be a Shopify merchant 12 months from now

Should you sell Shopify Stock?

In order to avoid any conflict of interest I don't trade individual stocks. I also don't give price targets. However I will tell you that I believe Shopify's stock is currently overvalued and here is why.

In an article I wrote last year I reported that enterprise value / revenue multiples ranged between 2.0x and 28.9x over a sample of 38 public SaaS companies. After having dug into Shopify's financial statements, my sense is that about 60% of Shopify's $144.8 million dollars of revenue is SaaS. In other words there is about $86.9 million in the latest twelve months.

Of course there is value in the low margin MP business, but if we stripped that out, today's $3 billion dollar valuation implies a 34.5x multiple to SaaS revenue. That's ridiculously high to me in light of the fact that merchant retention is 'consistent with what we would associate with early stage businesses'. My own experience on the platform also confirms this.

Yes, Shopify's potential to become an integral part of the selling process on Facebook is exciting. Personally I'll wait until the company begins to 'show me the money' before recommending that anyone buy shares.

If you found the article to be informative and are interested in the state-of-the-art for ‘social commerce’ follow me on Twitter @abegarver

Disclosure: The opinions expressed in this article are my own and not those of my employer, BG Strategic Adivsors.

#ShoppablePics.com#abe garver#ShoppablePics#Social Commerce#Shopify#$SHOP#Amazon#$AMZN#Facebook#$FB#Twitter#$TWTR#pinterest#apple#$aapl#@abegarver#Moving the e-Markets Index#Moving the e-Markets#Forbes

0 notes

Text

Will Gay Marriage Ruling provide an economic windfall to 1-800-FLOWERS.COM, Inc.? (Stock down 11.7% today)

Each week I trade insights with some of the most influential minds (CEOs, boards, shareholders, and leading journalists) in the e-commerce sector. Here are my thoughts after the earnings call. Find me @AbeGarver

I don’t believe shareholders are going to benefit much at all

In my opinion, it’s safe to assume that the Supreme Court Ruling making same-sex marriage a right nationwide will not provide an economic windfall to 1-800-FLOWERS.COM (NasdaqGS: FLWS) given the company’s announcement today that consolidated revenue growth in Fiscal 2016 will be in the 5%-7% range.

Here is why company’s Fiscal 2016 revenue guidance today was surprising

On the surface the guidance is surprising for two reasons:

(1) Last year FLWS was named to Internet Retailer’s 2015 Top 500 for fast growing e-commerce companies turning in 51.3% growth

(2) in an article last year, the Washington Post estimated that the (Supreme Court) decision could prove to be a $2.6 billion economic windfall for the wedding industry in the next three years when passed across the U.S.

1-800-FLOWERS is not a ‘Pure-play’ beneficiary of the Gay Marriage Ruling

Under the hood however, FLWS primary business (as a result of the Harry & David acquisition last year) is now Gourmet Food and Gift Baskets ($614.0M), followed by Consumer Floral ($422.2M), and Bloom Wire Services ($86.0M). In addition, we know occasions other than weddings (e.g. Mother’s Day, Valentine’s Day) contribute to the Consumer Floral and Bloom Wire Services. In other words FLWS is not a pure-play.

Here are two companies that could benefit however

If you are trying to profit from the Supreme Court’s gay marriage ruling, BlueNile.com (core business is the engagement category), and XO Group, Inc. (The Knot - the nation’s leading wedding resource) may be more attractive.

If you’re interested in more breaking news about the e-commerce sector including 1-800-FLOWERS, Blue Nile, or XO Group, please follow me on Twitter @AbeGarver

#abe garver#@abegarver#Moving the e-Markets#$flws#1-800-flowers#Blue Nile#$NILE#xo group#$XOXO#The Knot#gay marriage ruling#Internet Retailer#valentine's day#Mother's day#ecommerce#same-sex marriage

3 notes

·

View notes

Text

Oprah opens an e-commerce site, the O Store

(Guest post) BY SANDRA GUY Senior Editor, Internet Retailer You may follow Sandra @Sandraguy or email her at [email protected]

August 19, 2015, 5:03 PM

The actress and former TV host is selling products made exclusively for The Oprah Winfrey Network, plus items from her O List.

The world’s most famous talk show host is making it easier for her fans to get a piece of her online.

The Oprah Winfrey Network on Wednesday launched a new O Store, billing it as the official online retail store for exclusive OWN and Oprah merchandise along with curated lifestyle content.

The store sells products made exclusively for OWN, as well as items from the popular O List in O, The Oprah Magazine and OWN’s online learning platform, O Courses, the company announced.

“We are an ever-evolving brand and the O store is a new extension for us into the online retail space,” said Erik Logan, president of OWN: Oprah Winfrey Network. “This is a next step in connecting with our most loyal supporters, offering them a fun way to celebrate and be part of the OWN brand and what it represents.”

OWN has partnered with Delivery Agent to leverage the company’s data-driven commerce solution, integrated into television and social media platforms, to make it possible for fans to engage and buy on all their devices, from mobile to television, the company says.

At launch, the O Store will feature “Peace Love Oprah” merchandise, created by Miami-based clothing retailer PeaceLoveWorld. Styles from the line, made popular by Oprah’s The Life You Want Weekend tour last fall, include T-shirts, hoodies, sweatshirts and tops.

The selection of O List items, from O, The Oprah Magazine, includes such items as Oprah’s favorite jewelry and accessories to appliances and gadgets and treats she has loved over the years. Additionally, online O Courses from teachers such as author and speaker Iyanla Vanzant, pastor and author Rob Bell, speaker and author Brené Brown and media executive Arianna Huffington will be available, the company says. The O Store also will carry merchandise from TV shows on OWN, including “Super Soul Sunday.”

Abe Garver, Managing Director of BG Strategic Advisers, points out that businesses typically experience a huge boost in their website traffic and in store visits after being featured on the Oprah’s Favorite Things segment.

“For small businesses with limited resources and a small staff, the resulting boost in customers can cause the business to become overwhelmed and unable to meet customer demands,” he says. “(It’s a) quality problem to have.”

Garver says the new Oprah e-commerce site differs from many others in that it doesn’t ask for his email address the minute he landed on the site.

“It was not until I clicked ‘Shop Now’ that I was asked for my information, which felt fair,” he says. “Just like I’d be willing to give my credit card # as part of making the purchase.”

If you’re interested in more breaking news about Oprah, her O-List, or the O Store, please follow me on Twitter @AbeGarver

#SANDRA GUY#Internet Retailer#abe garver#Moving the e-Markets#erik logan O The Oprah Magazine Oprah Winfrey own The Oprah Winfrey Show#Erik Logan#the oprah magazine#Oprah Winfrey#OWN#The Oprah Winfrey Show

0 notes

Text

Speed Commerce CEO responds indirectly to ‘Dirt Swept Under the Carpet’ article and shares drop to 13 cents

In Dirt Swept Under The Carpet: Speed Commerce, Inc. Fiscal Q1 2016 Results I promised to immediately publish any response I received from Speed Commerce (’Speed’ or the ‘Company’) in regard to what I called ‘Dirt Swept Under the Carpet’.

Internet Retailer publishes story

Internet Retailer published a story about Speed yesterday titled E-commerce services provider Speed Commerce hits a rough patch (see below for complete text).

In the story Speed’s CEO, Richard Willis, told Internet Retailer that Speed was not forced to renegotiate the debt; it did so to ensure it met financial goals. “We gave ourselves a little cushion to make sure we were going to make what we said.”

Speed CEO’s comments contradict Speed’s 10K

Page 7 of its 10K -- We operate with significant levels of indebtedness and are required to comply with certain financial and non-financial covenants. “As of March 31, 2015, our total credit facilities outstanding, including debt and capital lease obligations was approximately $100.4 million, which was in excess of amounts permitted under our credit facility.”

Speed CEO spends $2.5 million for “A little cushion”?

For context $2.5 million dollars is very material amount for a Company whose market capitalization (stock price * shares outstanding) is less than $12 million. Let’s walk through some logic. If I’m the CEO of Speed and I’m trying to “make what I said” and I’m “not forced” why in the world would I incur $2.5 million of excess cost coupled with extremely onerous terms (described below).

Speeds’s amended debt terms

"On May 11, 2015, the Company entered into a Consent and Second Amendment to Amended and Restated Credit and Guaranty Agreement with Garrison. Pursuant to the Amendment, among other things, (i) permission to add back certain balance sheet write-offs to Adjusted EBITDA (as defined) for the calculation of financial covenants, (ii) subject to lender approval the ability to add back certain restructuring, transaction fees and expenses and one-time charges not exceed $2.5 million to the calculation of financial covenants, (iii) the interest rate on the facility increased to LIBOR +11%, with a 1% LIBOR floor, (iv) the Company will pay an amendment fee equal to 200 basis points, (v) the Company agreed to provide Garrison with certain additional forecasts and updates regarding the Company's liquidity and financial condition, and (vi) the Company is required to maintain a minimum of $1 million of unrestricted cash at all times." - Source: Speed Commerce 10-K dated 6/15/15, page 91

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

INTERNET RETAILER ARTICLE

E-commerce services provider Speed Commerce hits a rough patch.

August 18, 2015, 1:06 PM

BY SANDRA GUY Senior Editor, Internet Retailer

The loss of its biggest customer doesn’t dampen CEO Richard Willis’s optimism for the company’s future.

The CEO of Speed Commerce, an e-commerce fulfillment company, says the company is adding new customers, enjoying double-digit percentage sales growth and is on its way to a record holiday season despite losing its biggest customer, renegotiating its debt and facing a possible delisting of its stock.

“We are doing a better job than we ever have before—we’re excited about that,” president and CEO Richard Willis said Tuesday.

Speed Commerce has signed agreements with all 11 customers whose agreements have come up for renewal this year, Willis says. “Those are very important customers,” he says.

Glen Demeraski, CEO of Tabcom LLC, parent company of Dog.com, says in an email that his company renewed its contract with Speed Commerce through 2019 and feels confident that Speed Commerce “will right the ship.”

“We are concerned, but we have been working closely with Speed Commerce’s management and we are confident in their current plans to move forward,” Demeraski says. “There has been no deterioration in our service levels, and we are not anticipating one.”

Speed Commerce in April lost its largest customer, which accounted for 19% of its revenue in fiscal 2015, according to the company’s June 15 10K filing. That customer was tween apparel brand Justice, says Abe Garver, M&A adviser with BG Strategic Advisors.

Willis confirmed the loss of Justice and its sister brand, Dress Barn, both owned by Ascena Retail Group Inc., No. 87 in the Internet Retailer 2015 Top 500 Guide, but he says Speed Commerce has been up front about Ascena’s plans to take its e-commerce fulfillment in-house. Speed Commerce’s five largest customers accounted for about 42% of its fiscal 2015 revenue, according to the regulatory filing. Its clients include Yankee Candle (No. 391), Avenue, Spencers (No. 743 in the Internet Retailer 2015 Second 500) and Lenox, as well as The Army & Air Force Exchange Service, Navy Exchange Service Command and Veterans Canteen Services that provide online shopping services to members of the military and veterans.

Speed Commerce provides outsourced fulfillment services to five of the e-retailers in the Internet Retailer Top 1,000. It also listed as the provider of order management software for three of the Top 1,000, customer service software for two and the e-commerce platform for one.

Willis said during the Richardson, Texas-based company’s fiscal Q1 2016 earnings call on Aug. 10 that “this is the first quarter that we had that was impacted by the loss of several customers.” On Tuesday, Willis sought to downplay the challenges facing Speed Commerce, saying that, excluding the loss of Justice and other departing customers, overall revenue grew 56% and the average customer’s spending was up 10.7%.

However, Garver says Speed Commerce identified “material weakness in its internal controls over financial reporting that, if not remediated, could result in material financial misstatements.”

Willis says it was just a matter of moving funds from one category to another, and that Speed Commerce had no misstatements, restatements or change in its income statement.

The customer loss carries other costs. About 45 days after Speed Commerce announced the customer loss, Speed Commerce reached an agreement with a group of four lenders to amend its credit agreement, Garver says. “Speed Commerce had to do that because it didn’t have the income to service the debt payments on the $100 million it owed—primarily due to Speed Commerce’s acquisition of e-commerce fulfillment provider Fifth Gear on Nov. 24, 2014,” Garver says. Speed Commerce, under the new terms of the agreement, must pay a minimum of 12% interest on the debt, Garver says.

Speed Commerce had acquired Fifth Gear, a competing provider of e-commerce services, to expand its client base to include business-to-business customers like All Heart, Scrubs and Beyond, and RSI, the provider of uniforms to Burger King, Willis says. “It’s the fastest-growing section of e-commerce; it’s growing faster than the direct-to-consumer section. 25% of our sales are now business-to-business.” Prior to the acquisition, business-to-business accounted for less than 5% of sales, Willis says.

Willis says the company was not forced to renegotiate the debt; it did so to ensure it met financial goals.

“We gave ourselves a little cushion to make sure we were going to make what we said,” Willis says.

As to its stock, Speed Commerce in April said it had received a deficiency letter from the Nasdaq exchange notifying it that its common stock was subject to delisting because it didn’t meet minimum bid requirements. In its June regulatory filing, Speed Commerce stated it had until Oct. 5 to regain compliance with listing requirements. Those terms required the company to maintain a closing bid price of at least $1 per share for a minimum of 10 consecutive business days.

Willis says the stock issue will be resolved before Oct. 5 because the company plans a reverse stock split that will take the shares back above $1.

Speed Commerce’s stock closed Monday at 17 cents. The stock is down 93% for the past year.

A possible sale, first mentioned in April, remains a possibility.

If you’re interested in more breaking news about Speed Commerce or direction of its stock, please follow me on Twitter @AbeGarver

#richard willis#Internet Retailer#Speed Commerce#$spdc#abe garver#Moving the e-Markets#Glen Demeraski#TABcom#Dog.com#Yankee Candle#SANDRA GUY#$asna#Ascena Retail Group

0 notes